The Story

In 2017 a mix of naivety, flattery, a lack of experience and a bit of greed led me to merge my business with three other people aiming for a significant earn-out.

For those unfamiliar, an earn-out means you get paid based on the business’s performance after selling. Unfortunately, six days after signing away my shares, the credit crunch hit. My £2 million pipeline, crucial for my earn-out, evaporated.

I found myself out of control of my business, with limited earnings and a lot of stress. Unable to support the people involved in the business and restricted from working for myself due to the sale’s terms, I had to pivot.

Whilst it was hard to be positive staring down the barrel of insolvency. I looked at what I had enjoyed about my first roller coaster experience in business. These were the things I had never been able to do working for somebody else.

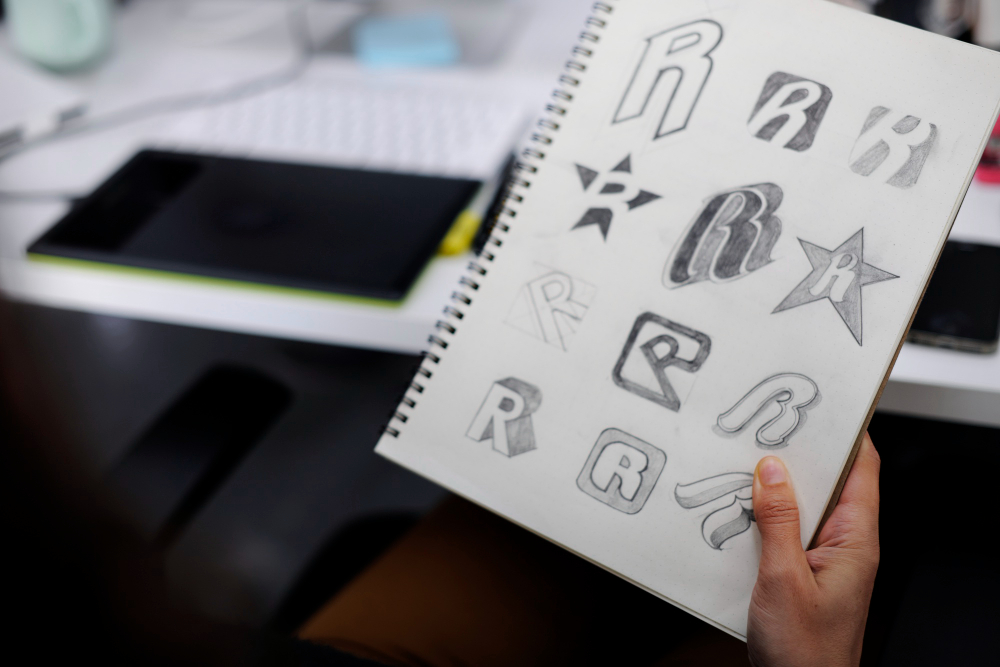

I loved developing a team, I loved building a brand, I had learned about websites and Google SEO and pay-per-click. I had forgotten that I am actually a creative person I love creating something from nothing and I love helping other people. What if I could make money other people with their digital marketing?

So, What Are the Hints and Tips for This Tale?

Hint –Learn what motivates you

Skip to today and running The Trademark Helpline has shown me that financial motivation isn’t everything. Investing profits back into the business to improve trademark registration and protection services has been more fulfilling. Helping small businesses through UK & International Trademark Registration and Support is a source of pride and inspiration to continue growing.

Seeing our unique approach to trademark registration become industry standards makes me proud. Helping small businesses avoid problems through UK Trademark Registration inspires me to grow and do more.

I initially thought going into business was about making money and giving myself a lifestyle. Which led to poor decisions because fundamentally, as much as I enjoyed giving great service to my clients, there was no passion or purpose beyond that.

But the need to pivot away from Financial Services reminded me that I am a creative. Invention drives me. I just didn’t think it would drive me to Trademarks!

Tip – Before you pursue more, take the time to be grateful for what you have.

For more business insights why not subscribe for more articles here.