Starting a new business?

During this exciting time, it’s all too easy to overlook some of the fundamentals that can make the difference between success and failure early on, some of which have significant associated costs. Failure to consider these expenses and plan accordingly is one of the key reasons for the alarmingly high rate of failure among new business ventures.

The good news is: it’s not all doom and gloom. With thoughtful planning, this can be avoided. Here is a checklist of some of the often overlooked potential expenses to help you avoid falling victim to unexpected costs and budget issues.

Incorporation

Depending on the type of structure you have selected, you may choose to incorporate your company. Incorporation requires you to register with companies house. Now, if you do this yourself, the cost is minimal, however, it is not uncommon to use a company to do this for you, particularly if your situation is more complex and you need a registered office. Another thing to keep in mind is that the home addresses of company directors are public record. If you wish to keep your personal information private you will need to plan to pay for a Director’s Service Address product at an additional cost.

Office Space or Premises

Chances are, you will need to find a place to work, especially if your business does not lend itself to being run out of a home office. Most businesses don’t own their own premises, but rather rent from a commercial landlord. Carefully consider the type of agreement you enter into and make sure you have an understanding of payment terms and contract lengths. Many leases are offered quarterly, rather than monthly and this can be an issue if you don’t plan your cash flow situation accordingly. Also, don’t forget to factor in furniture, utilities and anything else you need to turn a physical space into a workable space.

Stock, tools, equipment

What do you need to do business? If you’re a retail business, stock is likely one of your greatest expenses. Be sure to shop around for the best payment terms from suppliers— 30 or even 60-day payment terms can really make a difference to a new business’s cash flow starting out.

If you’re providing a service or manufacturing a product then make sure to consider the equipment and tools you need, taking into account that these tools and pieces of equipment could need to be replaced or repaired.

Business Insurance

Before opening your doors, your business should have a suitable business insurance policy in place. Depending on your circumstance, you may even have a legal obligation to be covered. The main types of business insurance to consider are public liability insurance, product liability insurance, employer’s liability insurance, business property insurance and professional indemnity insurance. There are a wide range of policies available to suit different budgets and requirements, so adequate cover can absolutely be obtained without breaking the bank. That being said, in the event that something does go wrong— not having the right type of coverage could be catastrophic. Many insurance companies offer combined coverage plans to help get you covered for less, so be sure to compare prices and policies from a number of insurers to get the best deal.

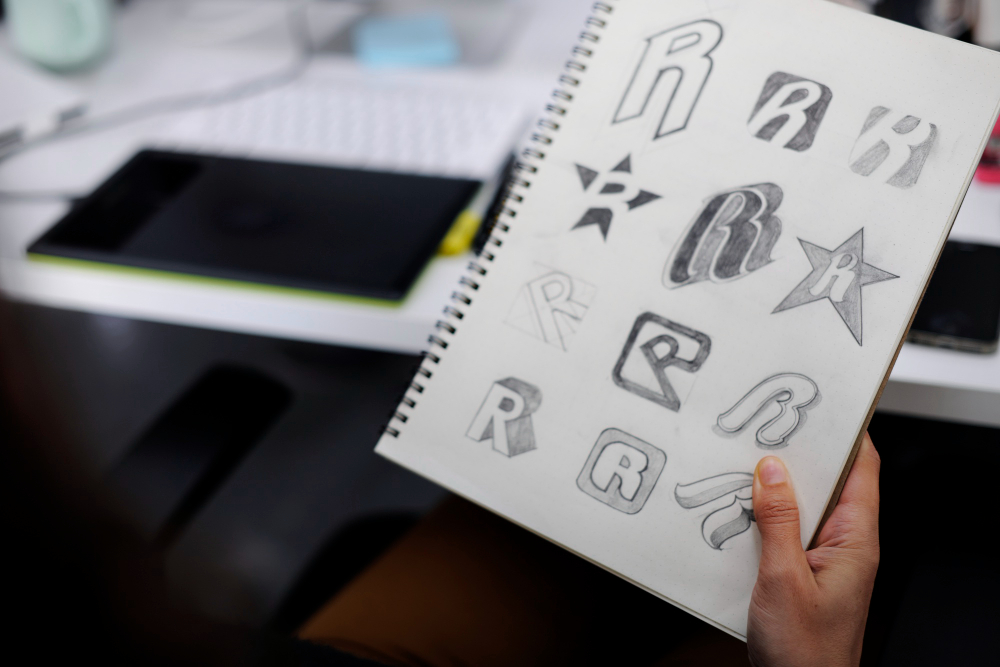

Marketing

How are you going to attract your customers or clients? You may be the best in the business, but if you don’t let people know about your company, they aren’t going to know to try you out. Marketing is one of the greatest expenses for a young company and unfortunately, it is often under accounted for. Have you thought about exactly what type of marketing techniques you will apply to get the word out about your business? Some methods are very inexpensive, but some have significant associated costs. Make sure you are realistic about what will work for you because the last thing you want is to find yourself struggling for cash and forced to cut marketing spend to the detriment of your business.

Travel

Consider whether you will need to be out and about meeting new clients or investors. If so, make sure you take into account the cost of travel. Will you be utilising public transport? Driving your car? Purchasing a company vehicle? All of the modes of transportation have associated costs. Make sure to factor these in when you are planning your cash flow.

Advice

Be it legal, accountancy, or even just general business guidance, many new companies do need to seek out the assistance of other experienced and specialised professionals at one point or another, often with significant cost. In many instances this advise is necessary and invaluable, however, it is important to plan for it so that you aren’t stuck with a bill that knocks your cash flow out of wack for months.